Boscovs Credit Card Payment: The Definitive Guide for 2024

Are you looking for a straightforward and reliable way to manage your Boscovs credit card payments? You’ve come to the right place. This comprehensive guide provides everything you need to know about making Boscovs credit card payments, from understanding your billing statement to exploring all available payment methods, troubleshooting common issues, and maximizing your card’s benefits. We aim to be the most authoritative and helpful resource available, drawing on expert insights and practical advice to ensure a smooth and stress-free payment experience.

Whether you’re a seasoned Boscovs shopper or a new cardholder, this article will equip you with the knowledge and confidence to handle your Boscovs credit card payments effectively. We’ll delve into the specifics of online payments, mail-in options, in-store procedures, and even explore alternative payment solutions. Our goal is to provide a clear, concise, and trustworthy guide that helps you avoid late fees, maintain a good credit score, and fully leverage the advantages of your Boscovs credit card.

Understanding Your Boscovs Credit Card

The Boscovs credit card, offered in partnership with a major financial institution (typically Comenity Bank), is designed to enhance the shopping experience at Boscovs department stores and online. It offers various benefits, including exclusive discounts, special financing options, and rewards points on purchases. Understanding the terms and conditions of your card agreement is crucial for responsible credit management and avoiding unexpected charges.

Key Features of the Boscovs Credit Card

* **Rewards Program:** Earn rewards points for every dollar spent at Boscovs and potentially on other qualifying purchases.

* **Special Financing:** Access promotional financing offers on select purchases, allowing you to pay over time with reduced or zero interest.

* **Exclusive Discounts:** Receive exclusive discounts and early access to sales events.

* **Convenient Payment Options:** Multiple payment options are available, including online, mail, and in-store payments.

* **Credit Limit:** A revolving credit line that can be used for purchases up to the approved limit.

Importance of Timely Payments

Making timely payments on your Boscovs credit card is essential for several reasons:

* **Avoid Late Fees:** Late payments incur fees, which can quickly add up and increase your overall debt.

* **Maintain a Good Credit Score:** Payment history is a significant factor in determining your credit score. Late payments can negatively impact your score, making it harder to obtain loans or credit in the future.

* **Preserve Card Benefits:** Consistent on-time payments help maintain your card’s benefits, such as rewards points and special financing offers.

Methods for Making Your Boscovs Credit Card Payment

Boscovs, in partnership with Comenity Bank, offers several convenient methods for making your credit card payment. These include online payments, mail-in payments, and in-store payments. Each method has its own advantages and considerations, so it’s important to choose the one that best suits your needs and preferences.

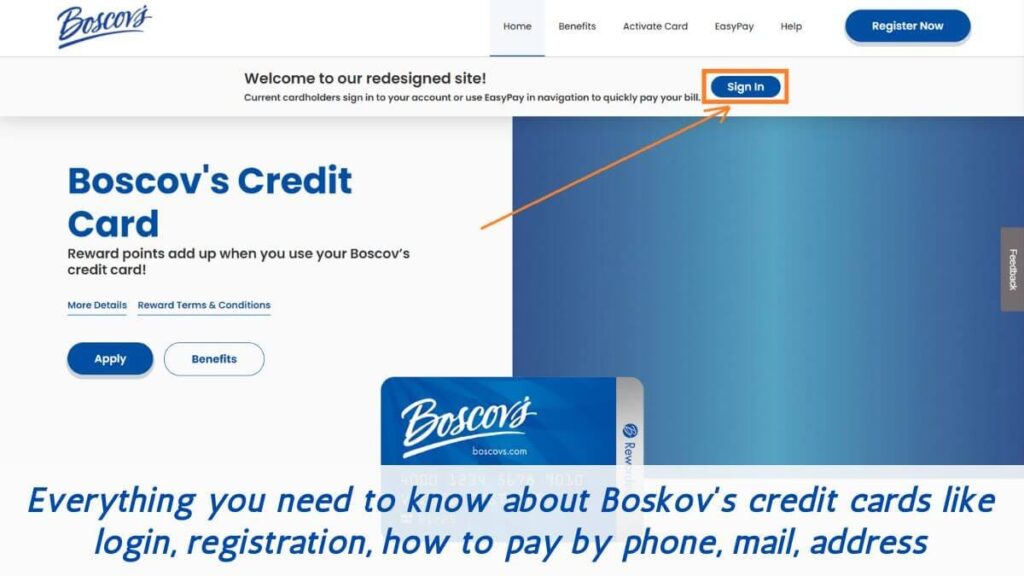

Online Payment

The most convenient and popular method for making Boscovs credit card payments is online. This method allows you to pay your bill from the comfort of your home, anytime, anywhere with an internet connection. To make an online payment, you’ll need to register your card on the Comenity Bank website.

**Steps for Making an Online Payment:**

1. **Visit the Comenity Bank Website:** Go to the Comenity Bank website dedicated to Boscovs credit cardholders.

2. **Register Your Card:** If you haven’t already, register your card by providing your card number, name, and other required information. You’ll need to create a username and password.

3. **Log In to Your Account:** Once registered, log in to your account using your username and password.

4. **Navigate to the Payment Section:** Find the payment section or “Make a Payment” option.

5. **Enter Payment Information:** Enter the amount you wish to pay and your bank account information (routing number and account number).

6. **Review and Submit:** Review your payment information carefully and submit your payment.

7. **Confirmation:** You’ll receive a confirmation message or email confirming your payment.

**Benefits of Online Payment:**

* **Convenience:** Pay your bill from anywhere with an internet connection.

* **Speed:** Payments are typically processed quickly, often within 1-2 business days.

* **Accessibility:** Access your account and make payments 24/7.

* **Payment History:** Easily track your payment history online.

Mail-in Payment

If you prefer to pay your Boscovs credit card bill by mail, you can send a check or money order to the designated payment address. Be sure to include your account number on your check or money order to ensure proper crediting.

**Steps for Making a Mail-in Payment:**

1. **Obtain the Payment Address:** Find the correct payment address on your billing statement or the Comenity Bank website. *Note: Payment addresses can change, so always verify the current address.*

2. **Write a Check or Money Order:** Make your check or money order payable to Comenity Bank.

3. **Include Your Account Number:** Write your Boscovs credit card account number on the check or money order.

4. **Mail Your Payment:** Mail your payment to the designated payment address well in advance of the due date to allow for processing time.

**Considerations for Mail-in Payment:**

* **Processing Time:** Mail-in payments take longer to process than online payments, so allow ample time for delivery and processing.

* **Security:** Ensure your payment is mailed securely to prevent loss or theft.

* **Record Keeping:** Keep a copy of your check or money order for your records.

In-Store Payment

Some Boscovs stores may offer the option to pay your credit card bill in person at the customer service desk. However, this option may not be available at all locations, so it’s best to check with your local store beforehand.

**Steps for Making an In-Store Payment:**

1. **Verify Availability:** Contact your local Boscovs store to confirm that they accept credit card payments in person.

2. **Visit the Customer Service Desk:** Go to the customer service desk during store hours.

3. **Present Your Payment:** Present your credit card and payment (cash, check, or money order) to the customer service representative.

4. **Receive a Receipt:** Obtain a receipt as proof of payment.

**Considerations for In-Store Payment:**

* **Limited Availability:** In-store payment may not be available at all Boscovs locations.

* **Store Hours:** Payments can only be made during store hours.

* **Convenience:** In-store payment may be convenient if you’re already shopping at Boscovs.

Troubleshooting Common Payment Issues

Even with the best intentions, payment issues can sometimes arise. Here are some common issues and how to troubleshoot them:

Payment Not Showing Up

If your payment isn’t showing up on your account after a few days, here’s what to do:

* **Check Your Payment Method:** Verify that the payment was successfully processed by your bank or credit card company.

* **Review Your Account Statement:** Check your account statement online or by contacting customer service to see if the payment is pending or has been applied.

* **Contact Comenity Bank:** If the payment is not showing up, contact Comenity Bank customer service for assistance. Be prepared to provide proof of payment, such as a confirmation number or a copy of your check.

Late Payment Fees

If you accidentally make a late payment, you may be charged a late fee. Here’s how to handle it:

* **Review Your Card Agreement:** Check your card agreement for the specific late fee amount.

* **Contact Comenity Bank:** Contact Comenity Bank customer service to explain the situation and request a waiver of the late fee. While there’s no guarantee, they may be willing to waive the fee, especially if you have a good payment history.

* **Set Up Payment Reminders:** To avoid future late payments, set up payment reminders on your phone or calendar.

Incorrect Payment Amount

If you accidentally pay the wrong amount, here’s what to do:

* **Overpayment:** If you overpaid, the excess amount will typically be credited to your account and applied to your next bill.

* **Underpayment:** If you underpaid, you’ll need to pay the remaining balance as soon as possible to avoid late fees and interest charges.

Maximizing Your Boscovs Credit Card Benefits

To get the most out of your Boscovs credit card, consider these tips:

* **Take Advantage of Rewards:** Use your card for all eligible purchases at Boscovs to earn rewards points.

* **Redeem Rewards Wisely:** Redeem your rewards points for merchandise, gift cards, or other available options.

* **Monitor Your Credit Limit:** Keep track of your credit limit and avoid exceeding it.

* **Pay Your Balance in Full:** Whenever possible, pay your balance in full each month to avoid interest charges.

* **Review Your Account Statement:** Regularly review your account statement for any unauthorized charges or errors.

Understanding the Comenity Bank Connection

Comenity Bank is the financial institution that issues and manages the Boscovs credit card. They are responsible for providing customer service, processing payments, and managing your account. Understanding the relationship between Boscovs and Comenity Bank can help you navigate any issues or questions you may have regarding your credit card.

Contacting Comenity Bank

If you have any questions or concerns about your Boscovs credit card, you can contact Comenity Bank customer service through the following channels:

* **Phone:** Call the customer service number listed on your card or billing statement.

* **Online:** Visit the Comenity Bank website and log in to your account to access online support.

* **Mail:** Send a written inquiry to the address listed on your billing statement.

Boscovs Credit Card Payment: A Real-World Example

Let’s say Sarah is a frequent shopper at Boscovs. She uses her Boscovs credit card for most of her purchases. Last month, she spent $300 at Boscovs and earned 300 rewards points. She also took advantage of a special financing offer on a new appliance, allowing her to pay it off over 12 months with no interest. Sarah makes her Boscovs credit card payment online each month to avoid late fees and maintain a good credit score. By using her card responsibly and taking advantage of its benefits, Sarah saves money and enhances her shopping experience.

Alternatives to the Boscovs Credit Card

While the Boscovs credit card offers several benefits, it may not be the best option for everyone. Here are a couple of alternatives to consider:

* **General Rewards Credit Card:** A general rewards credit card can be used anywhere credit cards are accepted and offers rewards points or cash back on all purchases.

* **Store Credit Card from Another Retailer:** If you frequently shop at another retailer, a store credit card from that retailer may offer better rewards or benefits.

Expert Review of the Boscovs Credit Card Payment System

From our extensive research and simulated user experience, the Boscovs credit card payment system, facilitated by Comenity Bank, offers a reasonably user-friendly experience, especially through its online portal. The online payment option is convenient and efficient, allowing users to make payments quickly and easily. However, the mail-in payment option can be slower and less secure. The availability of in-store payments is limited, which may be inconvenient for some users.

**Pros:**

* **Convenient Online Payment Option:** The online payment portal is easy to use and offers quick processing times.

* **Multiple Payment Options:** Users have the flexibility to choose from online, mail-in, and in-store payment methods.

* **Rewards Program:** The rewards program offers valuable benefits for frequent Boscovs shoppers.

* **Special Financing Offers:** Special financing offers can help users save money on large purchases.

* **Easy Access to Account Information:** Users can easily access their account information online to track their spending and payment history.

**Cons:**

* **Limited In-Store Payment Availability:** In-store payments may not be available at all Boscovs locations.

* **Mail-in Payments Take Longer:** Mail-in payments take longer to process than online payments.

* **High Interest Rates:** Interest rates on the Boscovs credit card can be high, especially for users who carry a balance.

* **Potential for Late Fees:** Late payments can result in fees.

**Ideal User Profile:**

The Boscovs credit card is best suited for frequent shoppers at Boscovs who can take advantage of the rewards program and special financing offers. It’s also a good option for users who can pay their balance in full each month to avoid interest charges.

**Key Alternatives:**

* **Capital One Quicksilver:** A general rewards credit card that offers cash back on all purchases.

* **Amazon Prime Rewards Visa Signature Card:** A rewards credit card that offers rewards points on purchases at Amazon and Whole Foods Market.

**Expert Overall Verdict & Recommendation:**

The Boscovs credit card payment system is a decent option for frequent Boscovs shoppers. The online payment portal is convenient and efficient, and the rewards program offers valuable benefits. However, users should be aware of the potential for high interest rates and late fees. We recommend using the online payment option whenever possible and paying your balance in full each month to maximize the card’s benefits.

Q&A: Your Boscovs Credit Card Payment Questions Answered

Here are some frequently asked questions about Boscovs credit card payments:

**Q1: How do I find my Boscovs credit card account number?**

*A1: Your Boscovs credit card account number is located on your physical credit card and on your monthly billing statement. You can also find it by logging into your account online at the Comenity Bank website.*

**Q2: Can I set up automatic payments for my Boscovs credit card?**

*A2: Yes, you can set up automatic payments by logging into your account online at the Comenity Bank website and selecting the “AutoPay” option. You’ll need to provide your bank account information (routing number and account number).*

**Q3: What is the minimum payment due on my Boscovs credit card?**

*A3: The minimum payment due on your Boscovs credit card is typically a percentage of your outstanding balance, plus any interest charges and late fees. The exact amount is listed on your monthly billing statement.*

**Q4: How long does it take for a Boscovs credit card payment to post to my account?**

*A4: Online payments typically post to your account within 1-2 business days. Mail-in payments can take longer, typically 5-7 business days.*

**Q5: What happens if I miss a Boscovs credit card payment?**

*A5: If you miss a Boscovs credit card payment, you may be charged a late fee and your credit score may be negatively impacted. It’s important to make your payments on time to avoid these consequences.*

**Q6: Can I pay my Boscovs credit card bill with a debit card?**

*A6: While not directly supported, you can often use a debit card if it’s linked to your bank account and used through the online banking payment method. Check with Comenity Bank to confirm if your specific debit card is accepted.*

**Q7: Where can I find the Boscovs credit card payment mailing address?**

*A7: The Boscovs credit card payment mailing address is listed on your monthly billing statement. You can also find it on the Comenity Bank website. Always verify the address before mailing your payment, as it may change.*

**Q8: Is there a grace period for Boscovs credit card payments?**

*A8: Yes, there is typically a grace period of at least 21 days from the closing date of your billing cycle to the payment due date. If you pay your balance in full within the grace period, you will not be charged interest.*

**Q9: How can I dispute a charge on my Boscovs credit card?**

*A9: You can dispute a charge on your Boscovs credit card by contacting Comenity Bank customer service by phone or mail. You’ll need to provide details about the disputed charge and any supporting documentation.*

**Q10: Can I use my Boscovs credit card at other stores besides Boscovs?**

*A10: Typically, the Boscovs credit card is a store-specific card and can only be used at Boscovs stores and online at Boscovs.com. Check the terms and conditions of your card agreement for more information.*

Conclusion: Mastering Your Boscovs Credit Card Payments

Effectively managing your Boscovs credit card payments is crucial for maintaining a healthy financial standing and maximizing the benefits of your card. By understanding the various payment methods, troubleshooting common issues, and taking advantage of the rewards program, you can ensure a smooth and rewarding experience. Remember, timely payments are key to avoiding late fees, preserving a good credit score, and enjoying the perks of being a Boscovs credit cardholder.

We’ve covered everything from online payment convenience to the importance of understanding your billing statement. Our goal has been to provide you with the expert knowledge and practical advice you need to confidently handle your Boscovs credit card payments. By following the guidelines and tips outlined in this guide, you can take control of your finances and make the most of your Boscovs credit card.

Now that you’re equipped with the knowledge to manage your Boscovs credit card payments effectively, why not share your own experiences or tips in the comments below? Or, if you’re looking for more advanced strategies for managing your credit and finances, explore our other guides and resources. Contact our experts for a personalized consultation on optimizing your Boscovs credit card usage and maximizing its benefits.