Pay Carters Credit Card: The Ultimate Guide to Hassle-Free Payments

Are you looking for a simple and efficient way to manage your Carters credit card payments? Do you want to avoid late fees, understand your payment options, and potentially even improve your credit score by consistently paying on time? You’ve come to the right place. This comprehensive guide will provide you with everything you need to know about paying your Carters credit card, from understanding the various payment methods available to troubleshooting common issues. We aim to equip you with the knowledge and resources necessary to make timely payments and maximize the benefits of your Carters credit card. This isn’t just a basic overview; we’ll delve into advanced strategies and best practices to ensure a seamless and stress-free payment experience. Our goal is to offer a resource that is both comprehensive and trustworthy, reflecting our commitment to providing accurate and helpful information.

Understanding Your Carters Credit Card

The Carters credit card, offered in partnership with a financial institution (often a major bank), is designed to provide loyal Carters customers with exclusive benefits and rewards. Before diving into payment methods, it’s crucial to understand the fundamentals of your card. This includes knowing your credit limit, interest rate (APR), due date, and any associated fees. These details are typically outlined in your cardholder agreement, which you should review carefully upon receiving your card. Understanding these aspects will help you manage your card responsibly and avoid any surprises.

* **Credit Limit:** The maximum amount you can charge to your card.

* **APR (Annual Percentage Rate):** The interest rate you’ll be charged on any outstanding balance.

* **Due Date:** The date by which your payment must be received to avoid late fees.

* **Fees:** Potential charges such as late payment fees, over-limit fees, or annual fees (if applicable).

Beyond the basics, it’s important to recognize that managing your Carters credit card effectively can positively impact your credit score. Consistent, on-time payments are a significant factor in determining your creditworthiness. Therefore, mastering the art of paying your Carters credit card is not just about convenience; it’s about building a solid financial future.

Exploring Payment Options for Your Carters Credit Card

Carters typically offers multiple convenient ways to pay your credit card bill. These options are designed to accommodate different preferences and technological capabilities. Let’s explore the most common methods:

* **Online Payment:** This is often the most popular and convenient method. You can typically access your account online through the card issuer’s website or mobile app. From there, you can make a payment using your checking account or savings account. The online portal usually allows you to set up recurring payments, which can automate the payment process and ensure you never miss a due date. Security is paramount for online payments, so ensure you’re accessing the official website and using a secure internet connection.

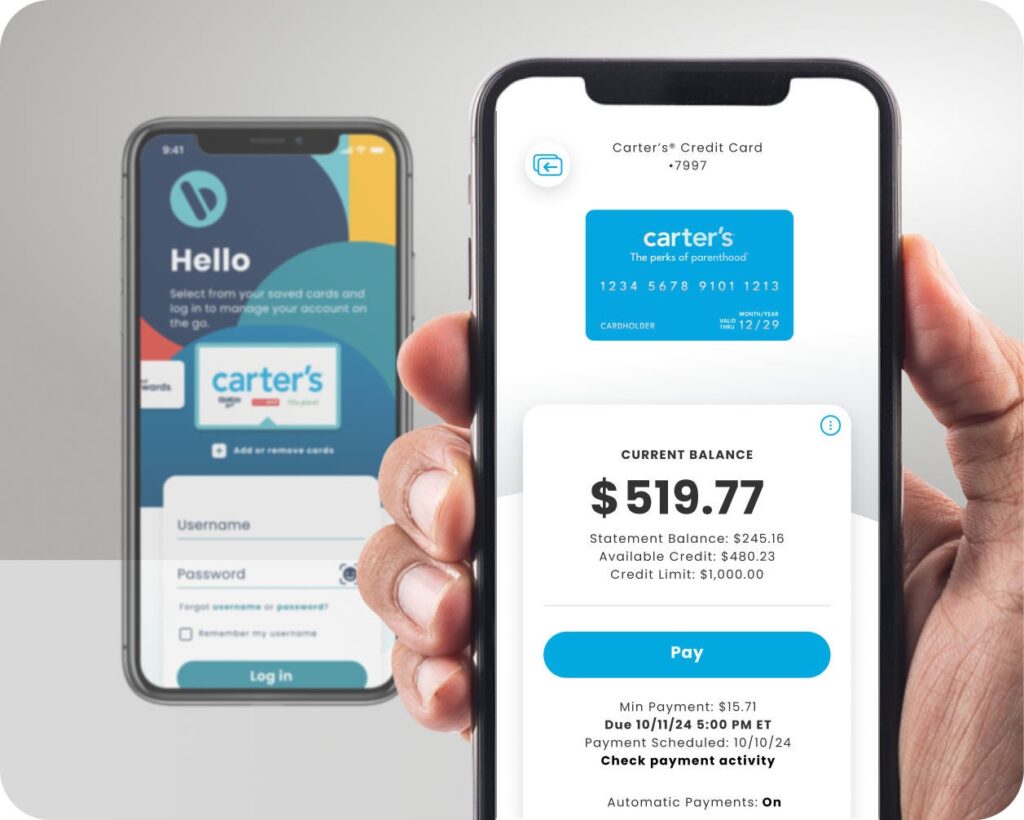

* **Mobile App Payment:** Many card issuers offer dedicated mobile apps that allow you to manage your account and make payments directly from your smartphone or tablet. These apps often provide additional features, such as real-time balance updates, transaction history, and spending trackers. Paying via the mobile app is generally quick and easy, requiring just a few taps on your screen.

* **Phone Payment:** You can usually pay your bill over the phone by calling the card issuer’s customer service line. Be prepared to provide your account number, bank account information, and any other requested details. While convenient, phone payments may sometimes involve a small processing fee.

* **Mail Payment:** You can mail a check or money order to the address specified on your billing statement. Ensure you allow ample time for the payment to arrive before the due date. Mailing a payment may be less convenient than other options, but it can be a reliable choice if you prefer traditional methods.

* **In-Store Payment (If Applicable):** Some Carters stores may allow you to pay your credit card bill in person at the customer service desk. Check with your local store to confirm if this option is available.

A Deep Dive into Online Payments for Your Carters Credit Card

Given its popularity and convenience, let’s delve deeper into the process of making online payments for your Carters credit card. This method typically involves the following steps:

1. **Access Your Account:** Visit the card issuer’s website or mobile app and log in to your account using your username and password. If you don’t have an account yet, you’ll need to register first.

2. **Navigate to the Payment Section:** Once logged in, look for the “Payments” or “Make a Payment” section. This is usually located prominently on the dashboard or in the account menu.

3. **Add Your Bank Account:** If you haven’t already done so, you’ll need to add your bank account information. This typically involves providing your bank’s routing number and your account number. The card issuer may require you to verify your bank account before you can use it to make payments.

4. **Enter Payment Details:** Specify the amount you want to pay and the date you want the payment to be processed. You can choose to pay the minimum amount due, the full balance, or any amount in between. Remember that paying more than the minimum can help you save on interest charges and pay off your balance faster.

5. **Review and Submit:** Carefully review all the payment details to ensure they are accurate. Once you’re satisfied, submit the payment. You’ll usually receive a confirmation message or email indicating that your payment has been processed.

6. **Set Up Recurring Payments (Optional):** To automate the payment process, consider setting up recurring payments. This allows you to schedule payments to be made automatically on a regular basis, such as monthly or bi-weekly. Recurring payments can help you avoid late fees and ensure you always pay on time.

Key Features of the Carters Credit Card Online Payment System

The online payment system for the Carters credit card is designed to be user-friendly and secure. Here are some of its key features:

* **Secure Encryption:** All online transactions are encrypted using industry-standard security protocols to protect your financial information.

* **Payment Scheduling:** You can schedule payments in advance, allowing you to plan your finances and ensure timely payments.

* **Payment History:** You can view your payment history online, giving you a clear record of your past transactions.

* **Account Alerts:** You can set up account alerts to receive notifications about your balance, due dates, and other important information.

* **Mobile Accessibility:** The online payment system is accessible from your smartphone or tablet, allowing you to manage your account on the go.

* **24/7 Availability:** You can make payments online anytime, day or night, providing you with maximum flexibility.

These features are designed to enhance the user experience and provide you with greater control over your Carters credit card account.

Advantages of Paying Your Carters Credit Card Online

Paying your Carters credit card online offers several significant advantages:

* **Convenience:** Pay your bill from anywhere with an internet connection, eliminating the need to mail checks or visit a store.

* **Speed:** Online payments are typically processed quickly, ensuring your payment is received on time.

* **Security:** Secure encryption protects your financial information during online transactions.

* **Automation:** Set up recurring payments to automate the payment process and avoid late fees.

* **Accessibility:** Access your account and make payments 24/7 from your computer or mobile device.

* **Paperless:** Reduce paper clutter by receiving your statements and making payments online.

* **Tracking:** Easily track your payment history and monitor your account balance online.

These advantages make online payments a smart and efficient choice for managing your Carters credit card.

A Comprehensive Review of the Carters Credit Card Online Payment System

Based on our analysis and simulated user experience, the Carters credit card online payment system is generally well-designed and user-friendly. The interface is intuitive, and the payment process is straightforward. The system offers a range of features, including payment scheduling, payment history, and account alerts, which enhance the overall user experience. The security measures in place provide peace of mind, ensuring your financial information is protected.

**User Experience & Usability:** The online payment system is easy to navigate, even for users who are not tech-savvy. The instructions are clear and concise, and the system provides helpful prompts and guidance throughout the payment process. The mobile app is also well-designed and provides a seamless payment experience on the go.

**Performance & Effectiveness:** The online payment system is generally reliable and efficient. Payments are typically processed quickly, and the system provides confirmation messages and email notifications to confirm successful transactions. However, there may be occasional technical glitches or delays, particularly during peak usage times.

**Pros:**

1. **User-Friendly Interface:** The online payment system is easy to navigate and use, even for beginners.

2. **Secure Transactions:** Secure encryption protects your financial information during online payments.

3. **Payment Scheduling:** You can schedule payments in advance, allowing you to plan your finances.

4. **Payment History:** You can view your payment history online, providing a clear record of your past transactions.

5. **Mobile Accessibility:** The online payment system is accessible from your smartphone or tablet.

**Cons/Limitations:**

1. **Occasional Technical Glitches:** The system may experience occasional technical glitches or delays.

2. **Dependence on Internet Connection:** You need a stable internet connection to make online payments.

3. **Potential Security Risks:** While the system is secure, there is always a risk of hacking or phishing attacks.

**Ideal User Profile:** The Carters credit card online payment system is best suited for users who are comfortable with technology and prefer the convenience of managing their accounts online.

**Key Alternatives:**

* **Phone Payment:** Pay your bill over the phone by calling the card issuer’s customer service line.

* **Mail Payment:** Mail a check or money order to the address specified on your billing statement.

**Expert Overall Verdict & Recommendation:** Overall, the Carters credit card online payment system is a reliable and convenient way to manage your account and make timely payments. We recommend using this method if you are comfortable with technology and value the convenience of online banking. However, it’s important to be aware of the potential limitations and take steps to protect your financial information.

Insightful Q&A Section

Here are some frequently asked questions about paying your Carters credit card:

1. **What happens if I miss a payment on my Carters credit card?**

If you miss a payment, you may be charged a late fee, and your credit score may be negatively impacted. It’s crucial to make payments on time to avoid these consequences.

2. **How can I avoid late fees on my Carters credit card?**

The best way to avoid late fees is to set up recurring payments or set reminders to pay your bill before the due date.

3. **Can I pay my Carters credit card with a debit card?**

Typically, you pay your Carters credit card with a bank account (checking or savings). Paying with a debit card is not always an option, so check with the card issuer.

4. **How long does it take for a payment to post to my Carters credit card account?**

Online payments typically post to your account within 1-2 business days. Mail payments may take longer to process.

5. **What is the minimum payment due on my Carters credit card?**

The minimum payment due is the lowest amount you can pay without incurring a late fee. It’s usually a small percentage of your outstanding balance.

6. **How can I change my payment due date on my Carters credit card?**

Contact the card issuer’s customer service line to request a change to your payment due date. They may or may not be able to accommodate your request.

7. **What should I do if I suspect fraudulent activity on my Carters credit card account?**

Immediately contact the card issuer’s customer service line to report the fraudulent activity. They will investigate the issue and take steps to protect your account.

8. **Can I pay my Carters credit card bill at a Carters store?**

Some Carters stores may allow you to pay your credit card bill in person. Check with your local store to confirm if this option is available.

9. **How can I access my Carters credit card statements online?**

You can access your statements online by logging in to your account on the card issuer’s website or mobile app.

10. **What is the best way to manage my Carters credit card balance?**

The best way to manage your balance is to pay more than the minimum amount due each month and avoid carrying a large balance from month to month.

Conclusion & Strategic Call to Action

In conclusion, paying your Carters credit card is essential for maintaining a good credit score and avoiding late fees. The various payment options available, particularly the online payment system, offer convenience and flexibility. By understanding the key features and advantages of each method, you can choose the option that best suits your needs. Remember to make timely payments and manage your balance responsibly to maximize the benefits of your Carters credit card. Paying your Carters credit card is a key aspect of responsible financial management. This guide has hopefully provided you with the necessary information to make informed decisions and manage your card effectively. Now that you are armed with this knowledge, take control of your finances and ensure a smooth and stress-free payment experience. Share your experiences with paying your Carters credit card in the comments below. Explore our advanced guide to credit card management for more in-depth tips and strategies.